FinTech (financial technology) is a catch-all term referring to software, mobile applications, and other technologies created to improve and automate traditional forms of finance for businesses and consumers alike. FinTech can include everything from straightforward mobile payment apps to complex blockchain networks housing encrypted transactions.

In this guide, we’ll discuss the various types of fintech, the skills needed to work in the field, and the job outlook for several fintech careers. We’ll also take a closer look at a few effective ways to learn key industry skills, such as an immersive online fintech bootcamp — a great way for aspiring fintech professionals to get hands-on experience.

FinTech 101: Understanding the Basics

A Simple Definition of FinTech

The term “fintech company” describes any business that uses technology to modify, enhance, or automate financial services for businesses or consumers. Some examples include mobile banking, peer-to-peer payment services (e.g., Venmo, CashApp), automated portfolio managers (e.g., Wealthfront, Betterment), or trading platforms such as Robinhood. It can also apply to the development and trading of cryptocurrencies (e.g., Bitcoin, Dogecoin, Ether).

A Brief History of FinTech

While fintech seems like a recent series of technological breakthroughs, the basic concept has existed for some time. Early credit cards in the 1950s generally represent the first fintech products available to the public, in that they eliminated the need for consumers to carry physical currency in their day-to-day lives. From there, fintech evolved to include bank mainframes and online stock trading services. In 1998, PayPal was founded, representing one of the first fintech companies to operate primarily on the internet — a breakthrough that has been further revolutionized by mobile technology, social media, and data encryption. This fintech revolution has led to the mobile payment apps, blockchain networks, and social media-housed payment options we regularly use today.

How Does FinTech Work?

While fintech is a multifaceted concept, it’s possible to gain a strong understanding. FinTech simplifies financial transactions for consumers or businesses, making them more accessible and generally more affordable. It can also apply to companies and services utilizing AI, big data, and encrypted blockchain technology to facilitate highly secure transactions amongst an internal network.

Broadly speaking, fintech strives to streamline the transaction process, eliminating potentially unnecessary steps for all involved parties. For example, a mobile service like Venmo or CashApp allows you to pay other people at any time of day, sending funds directly to their desired bank account. However, if you paid instead with cash or a check, the recipient would have to make a trip to the bank to deposit the money.

FinTech Trends for 2022

Over the years, fintech has grown and changed in response to developments within the wider technology sector. In 2022, this growth is defined by several prevailing trends:

- Digital banking continues to grow: Digital banking is easier to access than ever before. Many consumers already manage their money, request and pay loans, and purchase insurance through digital-first banks. This simplicity and convenience will likely drive additional growth in this sector, with the global digital banking platform market expected to grow at a compound annual growth rate (CAGR) of 11.5 percent by 2026.

- Blockchain: Blockchain technology allows for decentralized transactions without a government entity or other third-party organization being involved. Blockchain technology and applications have been growing quickly for years, and 2022 is likely to continue this trend as more industries turn to advanced data encryption. Check out our guide to blockchain technology if you’re interested in learning more.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML technologies have changed how fintech companies scale, redefining the services they offer to clients. AI and ML can reduce operational costs, increase the value provided to clients, and detect fraud. As these technologies become more affordable and accessible, expect them to play an increasingly large role in fintech’s continued evolution — especially as more brick-and-mortar banks go digital.

The Technologies That Power FinTech

Modern fintech is primarily driven by AI, big data, and blockchain technology — all of which have completely redefined how companies transfer, store, and protect digital currency. Specifically, AI can provide valuable insights on consumer behavior and spending habits for businesses, allowing them to better understand their customers. Big data analytics can help companies predict changes in the market and create new, data-driven business strategies. Blockchain, a newer technology within finance, allows for decentralized transactions without inputs from a third party; tapping a network of blockchain participants to oversee potential changes or additions to encrypted data.

How Safe is FinTech?

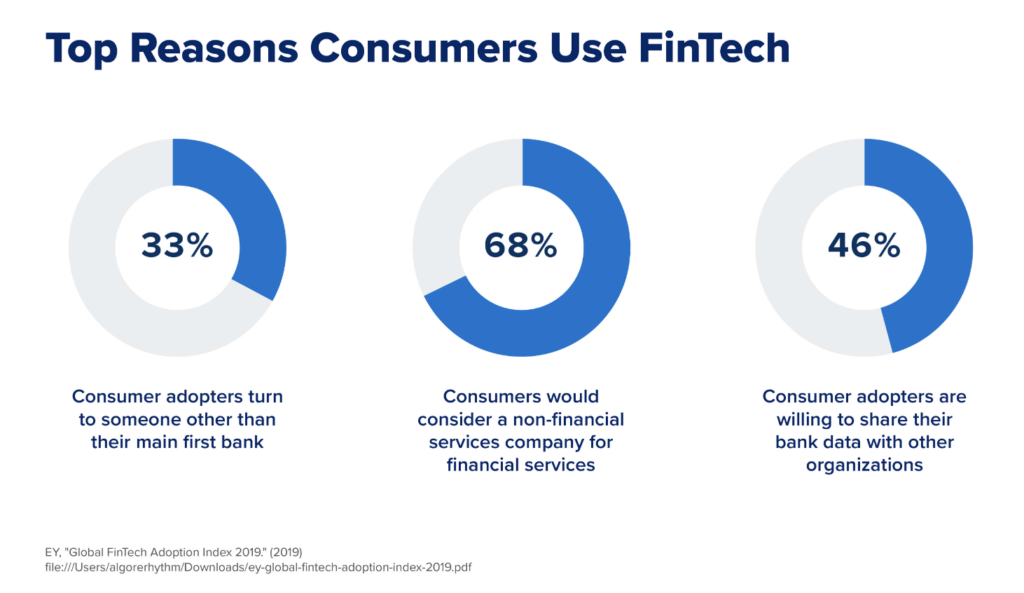

FinTech companies are generally trusted by consumers — according to Forbes, 68% of people are willing to use financial tools developed by non-traditional (e.g., non-financial, non-banking) institutions. However, many fintech applications are relatively new, and they’re currently not subject to the same safety regulations as banks. This doesn’t mean that consumers shouldn’t trust fintech companies with their money — it just means that being careful can be beneficial. For most consumers, the benefits of working with a fintech company outweigh the perceived risks.

Different Types of FinTech

FinTech has been used to revolutionize financial institutions for millions of people across the globe, changing how we pay each other, buy stocks and other financial instruments, and access financial advice. There are many different fintech companies offering unique services for their clients. Here are a few prominent examples:

How to Learn FinTech (and the Five Skills You Need)

FinTech is a growing field offering a variety of job opportunities for those with relevant experience. Are you interested in a career in fintech? Here are a few pathways for learning key industry fundamentals — plus several key skills to hone right away.

Programming:

A vast majority of fintech entities use mobile applications or websites to broaden their reach and increase consumer value. Programmers and software developers are primarily responsible for building and maintaining these fintech sites and applications, designing them to be secure, efficient, and navigable. Popular fintech programming languages include Java, C++, Python, and Ruby.

Cybersecurity

Most modern fintech companies are data-driven and often connected to vast digital networks which deliver new experiences and possibilities for users. This framework provides a great deal of value, but it can also increase the risk of cyberattacks and security breaches. Therefore, aspiring fintech professionals can benefit from a working knowledge of cybersecurity; studying how it is used to protect fintech companies from hackers and other cyber threats.

AI/ML and Data Science

Today’s fintech users generate quite a lot of data, and many fintech companies use this data to personalize their services and deliver additional value. Big data can be used to make financial predictions based on client behavior; managing finances for clients and leading to critical insights that enable stronger, more informed decision making. For this reason, ambitious fintech professionals will want to have a basic understanding of data analysis, as it will likely play a role in their long-term career.

Specifically, artificial intelligence (AI) and machine learning (ML) algorithms are regularly used to process and analyze large amounts of data; in doing so, they allow companies to generate actionable insights. AI/ML algorithms can lower risk, increase returns, automate processes, and make predictions for the future — and as a result, they stand as a valuable data-oriented skill for anyone wanting to work in fintech.

Blockchain

As cryptocurrency continues to become a prominent fintech sector, the need for blockchain savviness has grown to follow suit. It helps aspiring fintech professionals to have at least a working knowledge of blockchain’s underlying architecture and encryption attributes — as well as its various uses and implications in the broad trading, lending, and reconciling of currency all over the world. Blockchain-based cryptocurrency is expected to disrupt the financial industry for years to come, so having this type of skillset can make the transition easier to navigate.

FinTech Careers, Job Outlook and Salaries

FinTech has spawned a growing range of job opportunities for those interested in the field. Here is a quick overview of a few such careers:

Financial Analyst

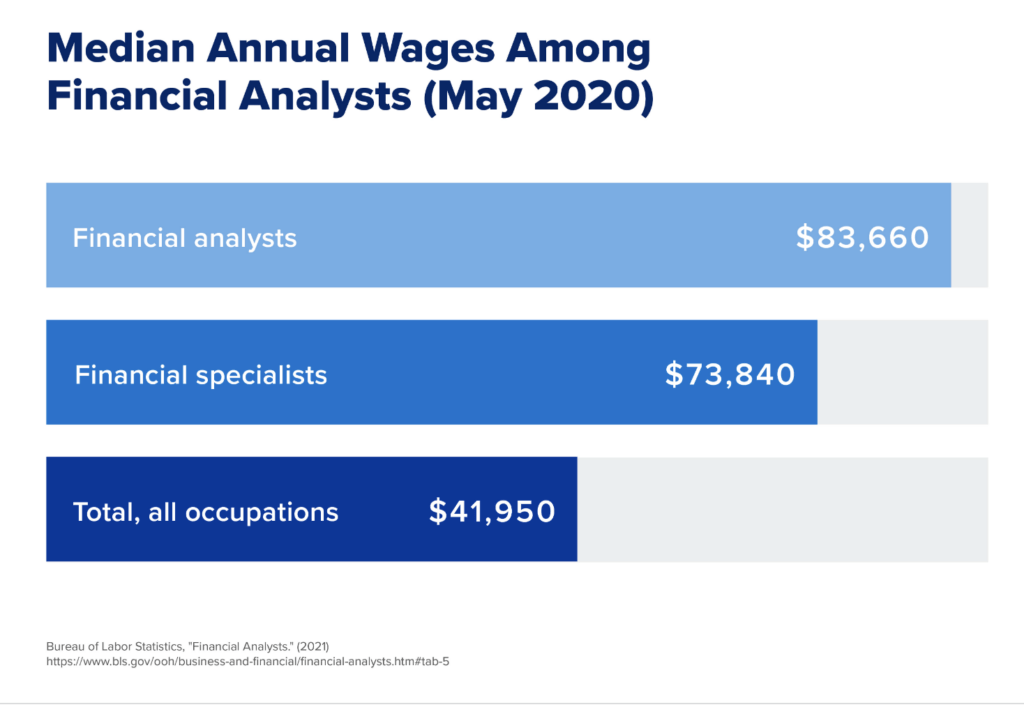

Financial analysts help businesses make decisions that can lead to stronger future returns. They employ high-level critical thinking to assess the performance of stocks, bonds, and other financial instruments. Currently, job prospects for financial analysts are strong. According to the Bureau of Labor Statistics (BLS), the field is expected to grow by 5 percent by 2029, and the median pay for a financial analyst was $83,660 in 2020.

ကြော်ညာ တွေဆိုတာ အောက် ပြတဲ့ ဟာတွေဖြစ်တယ်။ ကလစ်ပြီး သူတို့ website မှာ အနဲဆုံး ၁ minute လောက်နေပေးပါ

ကြော်ညာ 2

++++++++++++++