After seeing a lot of bad takes across the board from MSTR “liquidation” at $21K and them “losing money” each quarter, we’ve decided it’s best to create a basic overview for anyone new here. The main idea is that as we scale up we have to keep the readership quality high. We noticed a decline during Q4 and we’ll attempt to replace the people who shouldn’t be reading this side with people who should. After all our goal is to fund and create a ton of online businesses for the BowTied Jungle and the only way to do that is to attract smart/talented people who have yet to be “discovered”. People attempting to get rich off of a single VC investment are more likely to get rope-a-doped into buying Bitclout (now DESO) or Internet Computer (ICP).

အနဲဆုံး ၃၀-၆၀ စက္ကန့် ခန့် ဒီ စာမျက်နှာ ပေါ်တွင် ခဏနေပေးပါ။

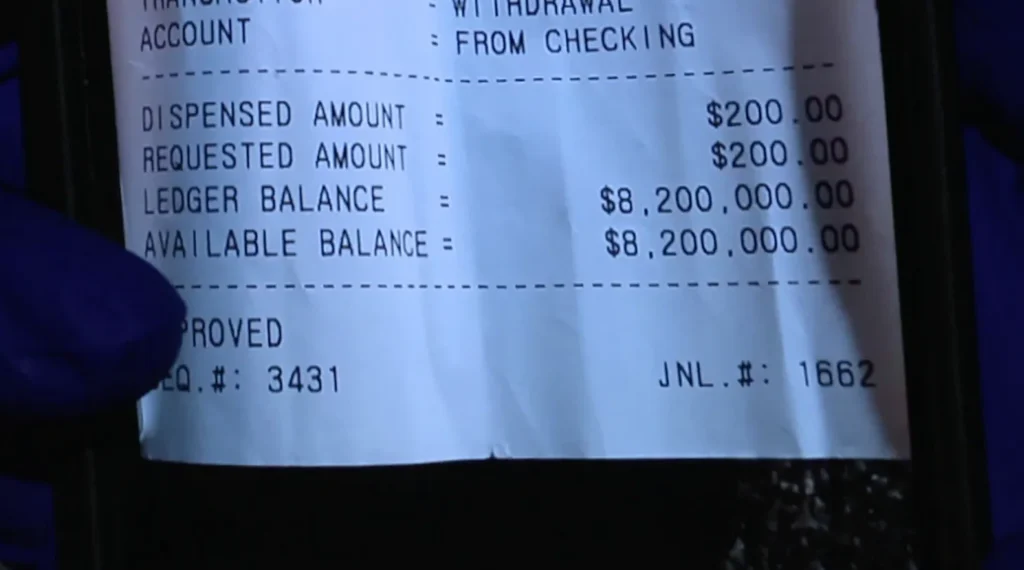

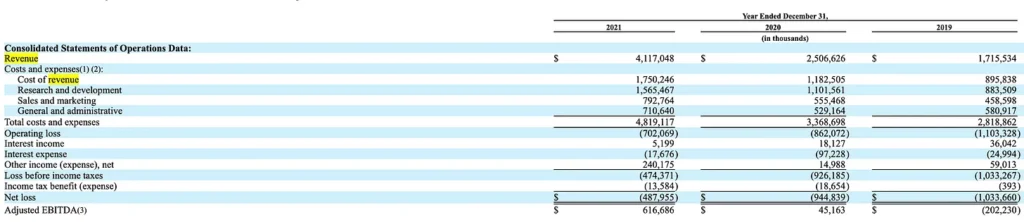

The Income Statement

Despite being the easiest to understand, people who have not run an online business can be easily fooled. You can have a checking account read “$150,000 balance” and the company is actually in the hole -$25,000 because they owe $175,000 in total marketing expenses, supplies, etc.

Doesn’t say much surprisingly!

Here is how we’ll define the Income Statement in parts.

Revenue/Sales: This is how much you sold. It doesn’t tell you how much about your cash profits. All it says is you sold X units and $X. If you sold 10 Ferraris for $10 each, you have $100 in revenue… As you can see from that example you likely lost millions if you did that.

Cost of Goods Sold (COGs): This is the materials you need to sell your product. If you run an ice cream shop, you need to buy sugar, plastic cups, spoons, milk etc. All of that would be Cost of Goods Sold because you can’t generate any revenue (ice cream sales) without those items.

Revenue – Cost of Goods Sold = Gross Profit

Operating Expenses: This is the cost of people and depending on your accounting the fixed expenses such as electricity, lease costs etc. To keep it simple we’re saying all operating expenses are everything except the items you need to buy to make your product. This is very specific and makes it a lot easier to follow. If you run an icecream shop we’ll classify the electricity, water, rental cost etc as an expense (yes you can easily argue they are COGs).

Gross Profit – Operating Expense = Operating Income

Other Expense: Here we get into annoying accounting items. We can use MicroStrategy as an example. According to current accounting methods if BTC price goes down they have to write a “loss” here. In addition, if price goes up they can’t claim a gain. Yes. This makes no sense but that’s the rule. Even though he doesn’t sell he has to write it down as a loss and even if price goes up he can’t register a gain on the income statement. For the majority, you can ignore this.

Majority: Other expense is going to be interest income on your cash balance (yes lol the 0.5% returns) and more importantly interest you have to pay on debt (if you lever up).

Operating Income – Interest Expense + Interest Income = Pre-tax Income

Taxes: At this point, you hopefully have a positive number. If you do you have to tax that positive number at your corporate rate. For some this is 35%, for others this is 0%. Depending on the business, jurisdictions etc, the tax rate can be outrageously different. To give you an idea on the importance of saving on taxes, a 35% tax that goes to zero would be no different than a 35% CAGR for your investment (collecting $1M versus $650K is not the same!).

Pre-tax Income – Taxes Paid = Net Income

Net Income: This is what your actual profit is. If you got $100,000,000 in sales and that number is in your bank account, no one knows if you’re rich. After you pay all the bills: people, rent, supplies, taxes, debt interest etc… Now you’re left with say $1,000,000. At that point you could then show the balance and say “here $1,000,000 in profit!”

Earnings Multiple: An earnings multiple is just a valuation methodology that is supposed to mirror a discounted cash flow statement. Since net income should match the cash you generate (over the long-term), a “P/E” multiple is just a net income multiplier (Net Income times a P/E multiple for the industry is the estimate for the equity value of the firm if it is private. The share count simply cancels – common question in finance to make sure people don’t memorize ratios)

At this point you should have a good understanding of why sales multiples are not the same as earnings multiples. If you succeed in your biz (many of you will!), try to shoot for an earnings multiple so you can run numbers hot into the sale.

Evaluating a Healthy Income Statement

Long-time readers have picked up on how we view the world. If you’re starting out we recommend finding industries that will always be around and already have a massive market: 1) diet, 2) skin care, 3) software and 4) any niche service – Air conditioning repair, plumbing etc. This is because there is a large addressable market and all you need to do is capture say 0.001% of it and you can make a living income. After you’ve successfully done this you can look at high-growth high-risk industries (computer coins, grey areas like marijuana etc.). These industries offer massive rewards because the long-term sales growth rate is HUGE, the problem is that your income volatility will be sky high versus something stable like makeup for women. In short, the benefit of established industries is that the margins are effectively established. If you go into high growth industries you could make huge profits but margins likely compress as competition comes in.

Sales: The number itself isn’t as meaningful as the growth rate. If you’re doing say $100,000 a quarter but you’re able to grow year over year about 7-10% it means you’re in a pretty healthy industry. Not hyper growth but healthy to say the least. Anything that is flat should be seen as a “burner business” where you just let it run and maximize margins. Anything 20%+ needs more marketing expense assuming you’re profitable. These are simple rules of thumb and don’t take them as “facts” more of a guideline.

If sales growth is not positive the valuation of the business should be hit significantly. It means that earnings over the next 10 years will likely go down. Instead of worrying about a single quarter or month, focus on the full year growth over 3-5 year time horizons. “Will more people use this” if the answer isn’t a resounding yes, it’s likely a stable (in-line with population growth) or flat business.

Gross Profit / Gross Profit Margins: Here is where you should focus a lot of your attention. What is the gross profit margin of the Company. We purposely moved all lease and capital expense to the OPEX line because you can really drill down and figure out if it is a “commodity” business or not. This phrase “commodity business” is just a nerd way of saying “no way to raise prices”.

If a company has pricing power it means that margins usually go up. Pricing power means you can charge more and more over time and there is nothing that people can do about it. You are too valuable and no one can compete with your product. Tech is a great example of this since something like iOS cannot be replicated any time soon.

Operating Expenses: Instead of focusing on operating profit, just look at the operating expense line. How much of the costs are really needed? Warehouses, sure. Sales people, yes if performing. Marketing, yes with focus on conversions. Human resources, admins, middle layers… not so much. Operating expenses should be as lean as possible (if you own it of course!) and if you’re looking to buy something you want to see massive bloat. Bloat usually means a lot of corporate politics and deadweight to remove – BowTiedNightOwl likely did tons of these in Private Equity. Rip out the cost and you don’t even need to grow much to make a high return. Software companies that don’t adopt remote work will also suffer the same fate, just cut all the overhead and improve profits without a single change to the revenue line.

If a company has high fixed expenses in terms of an investment, you probably want to run nowadays. Too hard to unwind. If a company has high variable expenses and recognizes the bloat, earnings should shoot up as the slack is ripped off. Note we’re definitely biased on that first sentence, we unloaded all of our rental property in 2021 and that will prove to be smart or dumb in 6-12 months.

Other Expense: For small time stuff (million dollar profit business or less), the chances of having anything significant here should be low. Maybe the Company has some small amount of debt/a cheap loan. That said, as you look at public companies, this line item can get a lot more complex (convertible bonds, short/long-term bonds, complex products to add in the other income line.

Instead of burning valuable time going through this, just assume that anything in the other expense line is debt/interest on cash related.

Taxes: Take a quick glance at the tax rate and decide if they are operating efficiently. If you look at the tax rate and realize they could lower it by simply moving, this is an opportunity or red flag (depending on what your plans are!). Rule of thumb, somewhere around 21% is a starting point.

Net Income: Finally the conclusion how much the company really makes. At this point it’s up to you to decide how sustainable this is: 1) is the industry going to grow?; 2) will they lose market share to competitors or gain market share?; 3) are profit margins sustainable; 4) are they benefitting from some loopholes or credits that may go away and 5) is the tax rate sustainable?

These are just some simple questions you should ask yourself.

SNAP!

At this point you have enough ammo to understand an income statement. For people who have looked at our old writings you also know how to decide which firms to work for (since many said no handouts we didn’t put those numbers in here!).

That aside we’re going to explain why we won’t invest in SNAP, using the same principles, even if it has a bounce or goes up some time in the future.

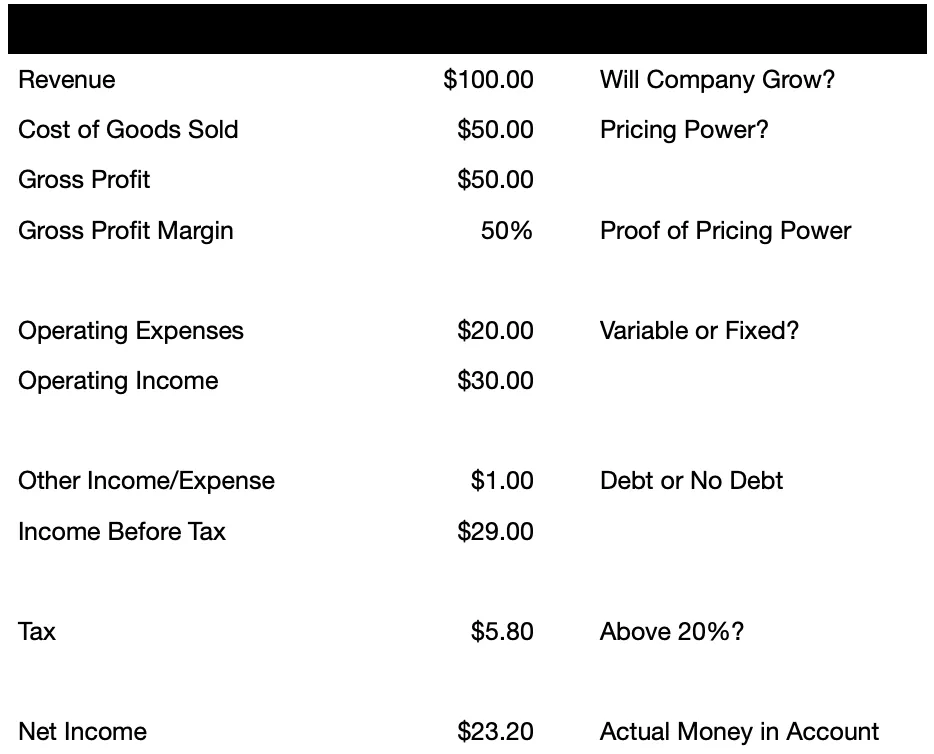

From item one we can see they actually do have some growth if we believe their DAU numbers from the 10-K filing.

This appears to be a decent growth Company the problem is that we’d wager more people move to TikTok and other social media avenues vs. Snapchat.

Moving down we can see that even though 2021 was good, the revenue increase of around $1.6B was offset by expenses growing a similar amount ~$1.5B. This is concerning because if you can’t turn a profit when everyone is at home staring at their computers/phones, it will be even harder to do so when people are going back to work.

Pausing: At this point you can still argue that growth is solid and they could just take down expenses. For the final part (since this is a public company), there is too much stock based compensation and too many shares being issued consistently making it hard to have earnings scale with the share dilution.

As usual we could be wrong but it seems that TikTok has taken over in terms of being the lowest of lowest common denominator.

ကြော်ညာ တွေဆိုတာ အောက် ပြတဲ့ ဟာတွေဖြစ်တယ်။ ကလစ်ပြီး သူတို့ website မှာ အနဲဆုံး ၁ minute လောက်နေပေးပါ

ကြော်ညာ 2

++++++++++++++